What is a Credit Score?

Use of a statistical model to objectively evaluate your creditworthiness based on all the credit information available. The score is a snapshot of your credit profile at particular point in time.

A Credit Score:

- Quickly and precisely assesses risk for loan repayment

- Can have varied ranges of scores depending upon the type of score used, ranging from 400 – 850

- Is sometimes referred to as a FICO® score, the most common score used by the bureaus

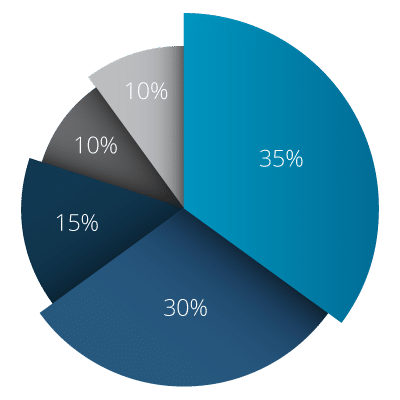

The Five Factors that make up Credit Scores

Improving your Credit Score

- Only apply for credit when needed

- Always pay bills on time

- Keep balances low on credit cards

- Pay off debt rather than moving it around

- Re-establish credit if there have been problems in the past; opening new accounts responsibly will improve credit scores over time

How Inquiries Impact the Score

- Inquiries made by you or your employer through a repository

- Multiple inquiries by mortgage companies and auto dealers made within a 30 day period are counted as ONE inquiry

- Credit inquiries remain on the credit report for two years, but impact the credit score for only one year

Staying Proactive

- Focus on methods of preventing problems

- Check your Credit Report annually using tools such as AnnualCreditReport.com

- Setup payment reminders/enroll in automatic payments

- Apply for new credit accounts only as needed

"*" indicates required fields

This is a secure website.

Your information is safe with us.

This is a secure website.

Your information is safe with us.

LET’S GET STARTED

We’re here to help answer your questions. The mortgage process can, but doesn’t have to be, complicated. Use this form if you’d like to learn more about eligibility, rates, special programs, refi opportunities, or pretty much any other question that you can dream up…